Tartu, Estonia - 12.11.2024

As businesses worldwide strive to enhance customer experiences post-COVID, Qminder leads with innovative solutions that streamline in-person service delivery and increase customer satisfaction. Today, the company announces a significant milestone, having secured €3 million in seed funding. Practica Capital led the round, marking its first investment in Estonia from their latest fund and Qminder’s first institutional funding. The round also included Jaan Tallinn’s Metaplanet, BADideas.fund syndicate, and strategic angel investors from Toggl, Veriff, Pipedrive, Wise, and Twilio.

Co-founded by Rauno Rüngas and Siim Raud, Qminder was born out of a desire to tackle inefficient service delivery in physical locations. With a 10-year track record of profitable bootstrapping and recognition as a market expert in queue management solutions, the company is already trusted by such industry leaders as Hertz, AMEX, American Express, and Delta. With this new capital, Qminder plans to accelerate the development of its platform and further the mission of transforming customer service flow management across various sectors.

Enhancing Visitor Experience and Satisfaction

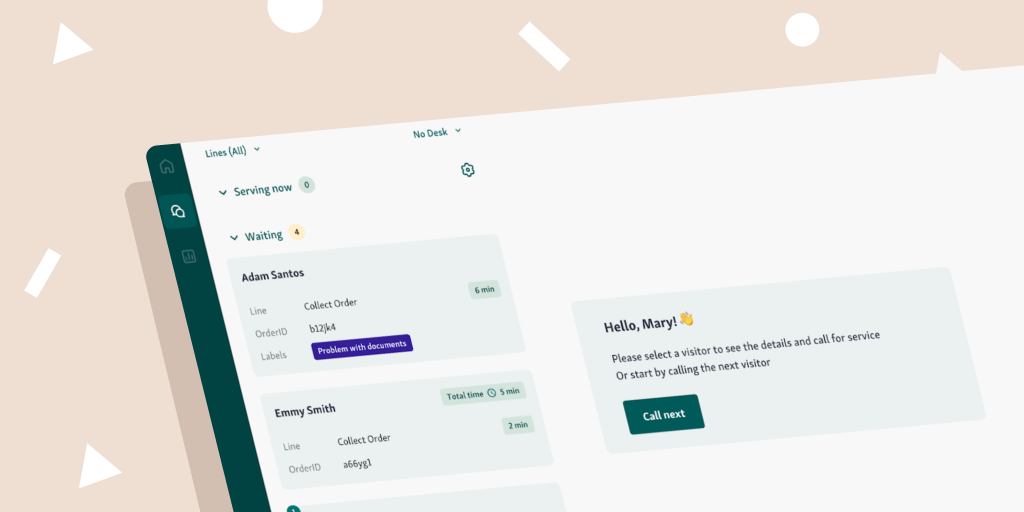

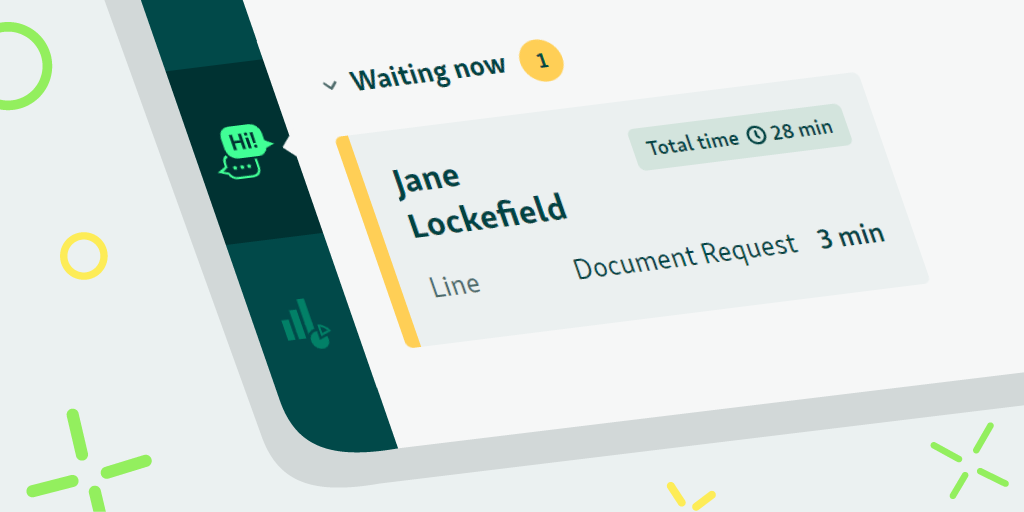

Qminder’s platform automates key customer service touchpoints, guiding visitors seamlessly from welcome to service. By managing communication and navigation, Qminder lets staff focus on delivering personalized service. The platform’s real-time insights allow managers to monitor and improve wait and service times, ensuring a smooth, satisfying customer journey. With features like automated check-ins, notifications, and queue management, Qminder empowers businesses to offer a well-organized, efficient experience that meets modern customer expectations.

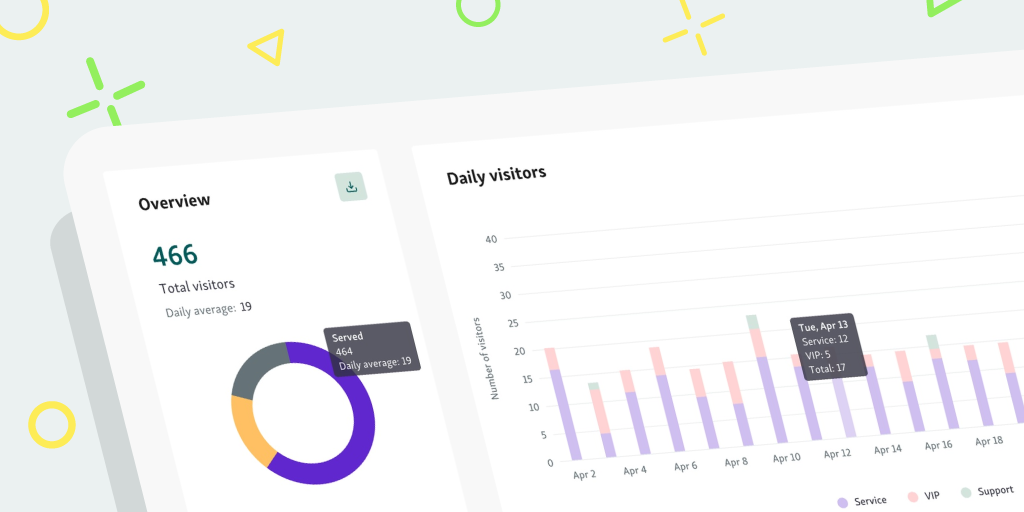

Service Intelligence for Operational Excellence

In-person service branches, like government permit offices and urgent care centers, face annual costs of up to $2 million per location in managing, organizing, and measuring services. Qminder’s platform addresses these challenges, equipping organizations with Service Intelligence to optimize operations through real-time insights and comprehensive reporting, to make better data-informed decisions. "Simply put, Qminder provides speed and order in service and numbers for managers," explains CTO Siim Raud, referencing various metrics available for analysis like visit trends, location volumes, and performance data. With its integrated customer Service Flow and Service Intelligence solutions, Qminder has already secured multiple Fortune 500 clients and nationwide enterprise rollouts.

“Previously, innovative front-line clerks, receptionists, and store managers implemented Qminder to manage individual waiting rooms and chaotic shop floors. Now, we are seeing VP-level decision-makers, customer experience consultancies, and analysts come to us to prevent such problems and make in-person service measurable from the start and at scale,” specified Rauno Rüngas, CEO of Qminder.

Accelerating Sustainable Growth and Team Expansion

With proven ROI highlighted by case studies and positive reviews from luxury retail brands and banks, Qminder is on track to triple its U.S. customer base, especially in local government and healthcare - sectors with a high demand for advanced Service Intelligence. This growth is driven by close client relationships and an expanding, talented team. Recent key hires from Pipedrive, Katana, and Veriff demonstrate Qminder’s ability to attract top industry talent, setting the company up for accelerated growth.

For more information, please contact us: info@qminder.com. Follow us on LinkedIn for updates.

About Qminder: Founded in 2011, Qminder is a customer service flow management platform dedicated to improving customer service experiences in physical locations. Serving a diverse range of clients, including Hertz, American Express, and Delta, Qminder leverages service intelligence via real-time data and reporting to enhance customer satisfaction, improve service delivery and optimize operations.

About Practica: Practica Capital is an early-stage VC dedicated to backing Baltic founders. The firm has been invested exclusively in tech potential in the Baltic States for over 10 years. Practica Capital backs great founders in their ambition in seed, selecting pre-seed and Series A stages and partnering with them as company builders. Practica Capital manages four funds with more than €130m in AUM. To date the firm has made over 70 investments, including great companies like PVcase, TransferGo, Ovoko, Eneba, Biomatter, Atrandi Biosciences, Heavy Finance, Montonio and others. Find out more: https://practica.vc